4 Easy Facts About Nj Cash Buyers Described

Table of ContentsThe smart Trick of Nj Cash Buyers That Nobody is Talking AboutExamine This Report about Nj Cash BuyersGet This Report about Nj Cash BuyersThe 6-Minute Rule for Nj Cash Buyers

Most states give customers a specific degree of security from creditors concerning their home. Some states, such as Florida, completely exempt your home from the reach of specific financial institutions. Various other states set limits ranging from just $5,000 to as much as $550,000. "That suggests, no matter the value of your house, financial institutions can not force its sale to satisfy their claims," claims Semrad.You can still go into repossession with a tax lien. For example, if you stop working to pay your home, state, or federal taxes, you can lose your home with a tax lien. Purchasing a house is a lot easier with cash. You don't need to wait for an inspection, appraisal, or underwriting.

(https://ko-fi.com/njcashbuyers1#paypalModal)I understand that lots of vendors are much more most likely to approve a deal of cash, however the seller will obtain the money no matter of whether it is financed or all-cash.

All about Nj Cash Buyers

Today, regarding 30% of US property buyers pay money for their residential properties. There may be some excellent reasons not to pay cash money.

You might have certifications for a superb home mortgage. According to a current study by Money magazine, Generation X and millennials are taken into consideration to be populaces with one of the most possible for development as debtors. Taking on a bit of financial obligation, particularly for tax functions fantastic terms could be a far better alternative for your funds in general.

Possibly buying the securities market, shared funds or an individual business could be a much better choice for you in the long run. By acquiring a property with cash money, you run the risk of diminishing your book funds, leaving you susceptible to unanticipated maintenance expenditures. Possessing a residential property requires ongoing costs, and without a home mortgage cushion, unforeseen repair work or restorations can strain your financial resources and prevent your capacity to maintain the building's condition.

Facts About Nj Cash Buyers Revealed

Home prices climb and drop with the economy so unless you're preparing on hanging onto the house for 10 to thirty years, you could be much better off investing that cash in other places. Investing in a building with money can speed up the purchasing process significantly. Without the demand for a home loan approval and associated paperwork, the deal can close faster, giving an affordable edge in affordable genuine estate markets where sellers may choose money purchasers.

This can result in significant cost savings over the long-term, as you will not be paying rate of interest on the car loan quantity. Cash buyers usually have more powerful negotiation power when handling sellers. A cash money deal is extra appealing to vendors because it lowers the danger of an offer failing due to mortgage-related concerns.

Remember, there is no one-size-fits-all option; it's necessary to tailor your decision based upon your private circumstances and lasting ambitions. All set to get begun taking a look at homes? Provide me a phone call anytime.

Whether you're selling off properties for an investment property or are vigilantly saving to purchase your dream residence, acquiring a home in all cash can significantly boost your buying power. It's a critical move that strengthens your placement as a purchaser and boosts your flexibility in the realty market. It can put you in a monetarily prone place.

Not known Facts About Nj Cash Buyers

Saving money on passion is just one of the most usual factors to purchase a home in money. Throughout a 30-year home loan, you could pay tens of thousands or even numerous thousands of dollars in total rate of interest. In addition, your investing in power boosts without any funding contingencies, you can discover a wider choice of homes.

The most significant threat of paying cash for a home is that it can make your financial resources unstable. Connecting up your liquid assets in a residential or commercial property can reduce monetary adaptability and make it more tough to cover unexpected costs. Furthermore, connecting up your cash means losing out on high-earning financial investment chances that might yield greater returns somewhere else.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Lacey Chabert Then & Now!

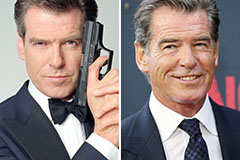

Lacey Chabert Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!